The extension will let you file your return by Oct. The extension only extends the time you have to file your return without penalties. If your extension is rejected by the IRS, we will provide you with both a reason for the rejection and the option to correct and retransmit the extension to the IRS at no additional cost. You must pay the money you owe the IRS by April 16, 2022. Once the IRS processes your extension, we will notify you of the filing status by email. > You can then review the Form summary, and E-file it with the IRS.

> You can choose to pay the balance due to the IRS using EFW, Check or Money Order. > Enter the estimate of total income tax payment and balance due, if any. > Enter your Personal Details such as Name, SSN, and Address. > Select the extension type you would like to file.

Irs e file extension 2016 download#

> Simply download our app, and log in to your ExpressExtension account. Get started with ExpressExtension, an IRS-authorized e-file provider for IRS tax extension forms, and e-file your Form 4868 for an automatic extension of time to file your personal income tax return.ĮxpressExtension provides a user-friendly, step-by-step filing process that helps you to file tax extension Form 4868 in minutes with the convenience of our mobile app. The Internal Revenue Service is reminding taxpayers that they can file for a six-month extension on. However, if form 4868 gets rejected for any other reason, users have the option to correct and resubmit at no additional cost.

Irs e file extension 2016 full#

In addition, ExpressExtension offers an Express Guarantee this tax season, meaning any user who files a Form 4868 and receives an IRS rejection stating duplicate filing will get a full refund. FileLater is an authorized IRS e-file provider and files both IRS Form 4868 and IRS Form 7004 electronically. The IRS suggests that individuals e-file their extension Form 4868 both for faster processing and the ability to get instant approval. FileLater provides a secure online solution for individuals and businesses seeking to e-file an IRS income tax extension. A properly and timely-filed Form 4868 extends the filing deadline for a nonresident alien to until December 15, this extension is NOT automatic. Form 4868 provides an automatic 6-month extension of time to file the 1040 income tax return with the IRS. E-Filing Taxes not only get to the IRS faster, they are processed faster as well. If you require more time to file a tax return, you can apply for an extension by filing Form 4868. Individuals that need more time to file their income tax returns can apply for an extension using Form 4868.

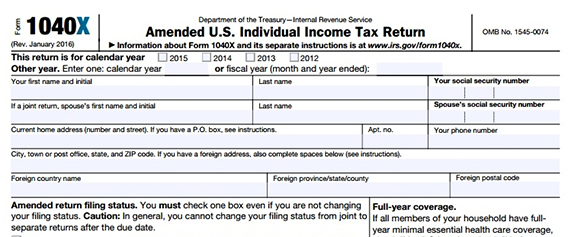

individuals must file their income tax return 1040 with the IRS this year by May 15. (Remember: you'll file in 2016 using the 2015 rates. I’ll have more updates on the 2016 tax season as it is made available. It's even more confusing if you file your return in Maine or Massachusetts: due to Patriots Day, the deadline will be Tuesday, April 19, 2016, in those states. If youve wondered about e-filing, here are the answers to frequently asked questions, including why e-filing is a good idea, which states let you e-file, how much e-filing costs, and how soon youll receive your refund. Estate or Trust Declaration for an IRS e-file Return 2016 Form 8453-I: Foreign Corporation Income Tax Declaration for an IRS e-file Return 2016 Form 8453-PE: U.S. Tax Day, which falls on a Friday, gets pushed ahead by statute to the next business day, which is Monday, April 18, 2016. Forget that paper tax return Electronic filing (e-filing), online tax preparation and online payment of taxes are getting more popular every year. Exempt Organization Declaration and Signature for Electronic Filing 2016 Form 8453-FE: U.S. That means, in 2016, Emancipation Day will be observed on Friday, April 15, on what would normally be Tax Day. Prepare and e-File your current year taxes by Tax Day, typically April 15.

Important: the date to claim any potential refund for a 2016 Return has passed you can no longer claim your 2017 Tax Refund from your 2016 Return. By law, when April 16 falls during a weekend, Emancipation Day is observed on the nearest weekday – not necessarily the following weekday. Instructions and calculators for 2016 IRS or State Tax Returns are outlined below. You’d think that Emancipation Day would get pushed ahead to Monday, Ap– but it doesn’t. In some years, the District of Columbia observes Emancipation Day on the same day as Tax Day, which affects the nation’s tax filing deadline – so the deadline gets moved.Įmancipation Day falls on a Saturday in 2016. Traditionally, Tax Day is April 15 unless that date falls on a Saturday or a Sunday, in which case the due date for federal income tax returns gets pushed ahead to the next business day.

0 kommentar(er)

0 kommentar(er)